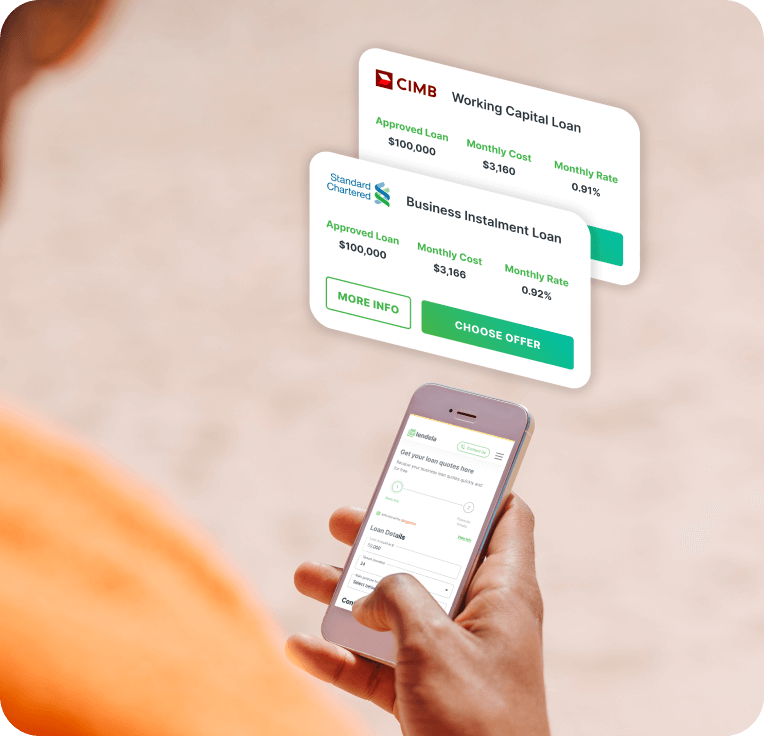

Business Loans.

Simplified.

Grow your SME with Lendela’s finance matching solutions, connecting you to both banks and financial institutions.

Get Loan Quotes

Supported by:

Why businesses choose Lendela

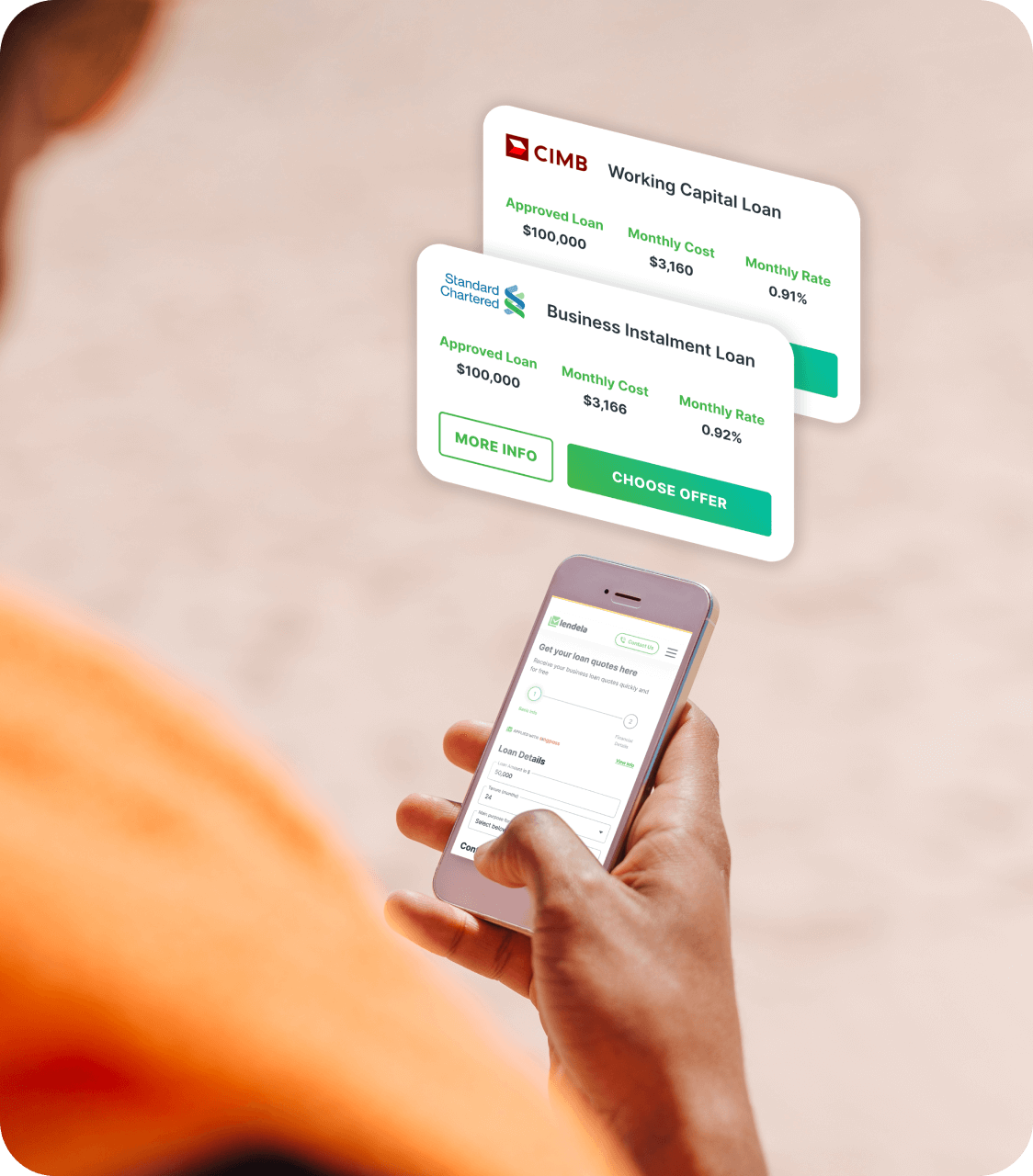

Fully independent service

Not favouring any partners, we take your side to ensure you get the most competitive and suitable offers.

Secure your full loan amount with our range of lender options

Pulling knowledge and experience across our extensive network of banks and credit partners, we find the best loan structure to achieve your desired full loan amount.

Higher approval rates than direct applications

Don’t risk rejection! Our established partnerships and expertise unlock higher approval rates for your business loan.

Our customers speak for us

1184 Reviews

Term Loans

Term loans provide businesses with a lump sum amount upfront, repaid over a specified term with fixed or variable interest rates, supporting long-term investments or projects.

Invoice Financing

Invoice financing allows businesses to secure immediate funds by using their outstanding invoices as collateral, bridging cash flow gaps without waiting for payment from customers.

Micro Loans

Micro loans are tiny-scale financial aids designed for entrepreneurs and small businesses, offering modest amounts to support more immediate needs.

We work with the best

As featured on

We’re ready help you to grow your business

Take the first step towards securing funding. Request for loan quotes today.

Get Loan Quotes