Lendela’s Lowdown

Credit as a cash flow management tool: Credit can be a valuable tool for managing cash flow when leveraged strategically, especially during emergencies (sudden medical expenses) or for major milestones such as higher education and home renovations.

A good credit score can make or break: A high credit score offers significant advantages, including lower interest rates, better loan terms, and large savings when you most need it, such as during emergencies.

Avoid making consecutive loan applications: Simply comparing loan rates by applying with multiple banks hurts your credit score and is no longer the best way to find your ideal loan—loan matching connects borrowers with multiple personalised loan offers from banks and providers in minutes, and without hurting their credit scores.

While our ability to navigate credit is one of the make-or-breaks of personal financial health, it remains a surprising fact that many Singaporeans understand very little about the 101s — how credit scores are determined, the material impact a good or bad score can make on someone’s life, and even the role credit plays in early retirement planning.

An illustration of this can be gleaned from the reported uptick in credit card debt among Singaporeans in recent years, with many working adults paying the minimum sum on their monthly credit card bill and the number of people who need help managing their debt also on the rise.

What also stood out was that about half of the people who sought help managing debt, according to Credit Counselling Singapore, were under 40 years of age.

In other words, a sizable portion of Singaporeans in their prime earning years who are often navigating significant life milestones such as home purchases, advanced education, and early retirement or family planning, are seemingly struggling with debt, which often stems from a lack of understanding of the role of credit in financial planning.

The duality of credit

Firstly, credit is a powerful tool that can smooth out cash flow bumps, help manage emergencies, or fund major life milestones. Data from Lendela, a loan matching platform that matches borrowers with personalised loan offers in Singapore, cited that about 1 in 3 borrowers take out loans for big-ticket purchases including business expansion, car, education, home-related expenses, medical expenses, home renovation, and wedding costs.

However, wield it carelessly, and you might find yourself in a bit of a pickle. In Singapore, your financial health is often epitomised by a single number: the credit score. A credit score is what lenders use to:

figure out how likely someone is to pay back their debts

see how risky it is to lend money to someone

understand someone’s existing debt obligations

This score ranges from 1,000 (HH) to 2,000 (AA), where anything above 1,900 is considered excellent, affording you a host of privileges, including but not limited to:

Lower interest rates on loans and better loan terms

Additional perks that can sometimes include cashbacks, vouchers, vacations, and air miles

Better chances of being approved for loans, credit cards, and other lending facilities when you need them — for instance, data from the Credit Bureau of Singapore (CBS) shows that individuals with scores in the AA category have an approval rate for new credit applications up to 30% higher than those in the DD category

Higher loan limits should you need it, especially for big-ticket purchases and expensive life milestones

Leverage to negotiate a lower interest rate on a new loan, particularly when it comes to refinancing a loan

Apart from these privileges, there’s also a strong case to be made for the significant monetary savings that many may not realise. For instance, improving your credit score from CC (1,825-1843) to AA (over 1,911) could reduce mortgage interest rates by up to 0.5%, which on a $500,000 loan over 30 years translates to about S$50,000 in savings. Similarly, for personal loans, a better credit score can reduce the interest rate by up to 4%. On a $50,000 loan with a 5-year term, a 2% reduction saves about $5,000 in interest.

Building a healthy credit history

Your credit history is essentially your financial track record—it shows potential lenders how responsible you are with money. By maintaining a solid history, which includes making timely payments and managing your debt strategically, you enhance your credibility.

Maintain credit limits

Keep your credit utilisation low — ideally under 30% of your credit limit. A high utilisation can signal to lenders that you're overly reliant on credit, which can negatively impact your score. For example, if your credit limit on a card is $10,000, try to maintain a monthly spending limit of no more than $3,000.

Avoid making consecutive loan applications across multiple banks

Each time a bank or credit provider pulls your credit report in response to a new loan application, an enquiry is placed on your file. Having too many enquiries in your credit report indicates to lenders that you are credit hungry and in urgent need of cash, and applying for several loans or credit cards in a short period can compound this effect, making you appear financially desperate or risky. On top of that, inquiries by financial institutions for your credit report will be retained for 2 years.

In reality, this is one of the best arguments against manually “shopping” for the best loan offer in town, which many Singaporeans do when in need of a loan. The simple act of comparison between lenders and rates inadvertently penalises the borrower by lowering their credit score, and Singaporeans seldom realise this.

This is also why platforms such as Lendela exist—through a single application, borrowers are matched with multiple pre-approved loan offers personalised to their profile, bringing offers to them instead of the other way around and protecting their credit scores.

Repair damaged credit history with manageable short-term loans

If your credit score has taken a hit, consider taking out a small, manageable short-term loan that you can repay easily. Consistently making timely repayments can improve your credit score as this shows lenders that you are responsible and capable of managing debt effectively.

Avoid paying only the minimum sum on your credit card bill

Consistently paying only the minimum on your credit card can lead to unmanageable interest charges and may suggest to lenders that an individual could be struggling to manage their debt. ValueChampion’s data shows that the average interest rate on credit cards in Singapore is about 28% per annum.

Aim to pay off the full balance each month, and if that’s not possible, pay more than the minimum to reduce the principal faster and decrease the total interest accrued.

Manage credit card exposure

Having multiple credit cards can be beneficial for improving your credit score by showing that you can handle various credit lines responsibly. However, it’s essential to manage them well. Ensure you use your cards regularly but keep the utilisation rate fairly low (discussed above) and always pay on time. If you fail to use a card regularly, it creates the impression that you can easily become indebted, which is why periodically assessing your cards and closing seldom-used accounts is necessary.

Strategic borrowing: Making informed choices

Using credit strategically can be a game-changer. It involves understanding when taking on debt makes financial sense and how it can be leveraged for substantial long-term benefits.

Education

Funding further education is a prime example of strategic borrowing. The returns on investing in higher education are clear, with graduates seeing substantial increases in their earning potential. For instance, obtaining a Master’s degree in Singapore can lead to an average salary increase of around 30%. This makes education loans a wise financial decision for those looking to advance their careers and who may not have the necessary liquidity to pay for it in full.

Home renovations

Given how commonplace home renovations are in Singapore, it’s useful to understand the strategic role a loan might play here. Apart from aesthetic improvements to enhance your home's market value, new homeowners and reno-hopefuls are often caught off guard by ancillary costs of renovations. From air conditioning and extensive electrical works to furniture and large appliances, these substantial costs often present a temporary cash flow challenge for many.

For instance, the average cost of furniture and large appliances for a new home in Singapore has been reported to start from S$15,000 and go up to S$70,000, while electrical works range from S$4,000 to S$7,000 for new homes. It’s in these times when loans can become a strategic tool.

Debt consolidation

It’s become apparent over recent years that the number of Singaporeans holding on to large outstanding debts is on the rise, with more seeking help from social service agencies in 2023. Having several large outstanding debts that someone is unable to pay down can severely impact their credit score over time, which is why it’s essential to understand the options for someone in such a situation.

Consolidating multiple high-interest debts into a single lower-interest loan can reduce monthly payments and simplify one’s finances. For instance, instead of juggling payments on three credit cards and a personal loan, it is often more prudent to consolidate them into a single loan with a lower rate.

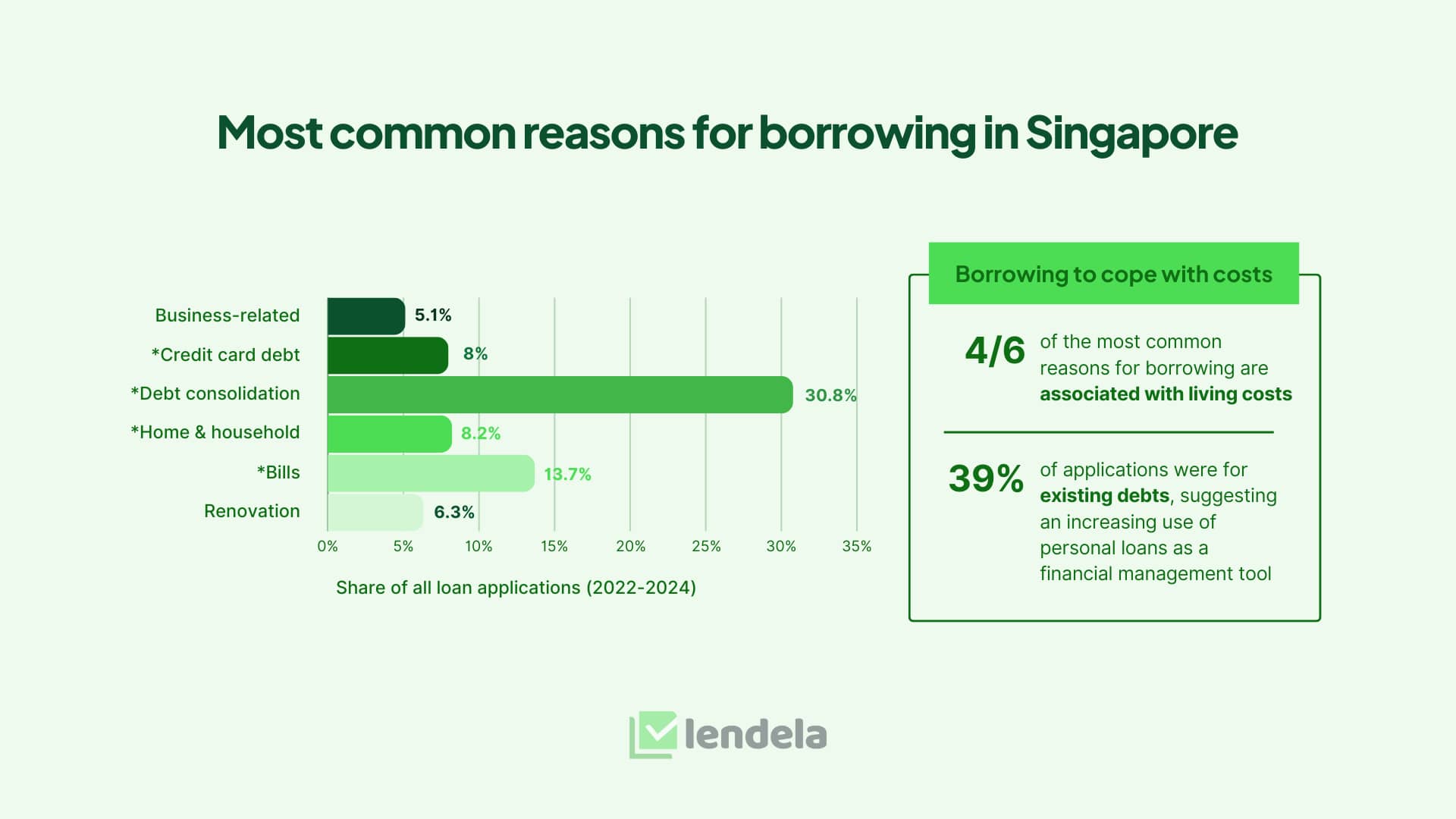

Data from Lendela’s August 2024 report, Coping in the costliest city in the world, shows that this is commonplace in Singapore and that about 30% of borrowers have taken out a debt consolidation loan.

Source: Lendela media report - Coping in the costliest city in the world

Source: Lendela media report - Coping in the costliest city in the world

In selecting a debt consolidation loan, favourable terms are especially critical. Finding a plan that helps to push the overall cost of debt down with a significant margin is key to swinging things in one’s favour, and the utility of comparing between multiple loan offers instantly and without hurting one’s credit score becomes very apparent.

Credit is a powerful tool — learn to wield it

As you can see, navigating credit is really more than just a good-to-have — it’s a strategy that can provide both immediate and lasting financial upside. By maintaining a robust credit score, choosing strategic borrowing opportunities, and aligning them with your long-term financial goals, you can turn credit into one of your most valuable financial tools.

Credit should empower you, not encumber you. By making informed decisions around credit, you can improve your immediate financial standing while also paving the way for your longer term financial goals.