Life’s major milestones often come at exciting stages of our lives and bring a great deal of fulfilment to many Singaporeans. From envisioning the dream wedding to unlocking years of pent-up interior design inspiration, these couple milestones bring us a lot of joy, but can also have a tremendous impact on a couple’s financial position overnight.

Since most of these costs tend to occur one after the other in a short span of time, how can we navigate them to ensure they lead to more happy memories and less financial stress?

We’ll take you through some common as well as hidden costs of this triple threat, discuss some strategies we’ve found useful, and highlight some tools that may come in handy, including the calculated use of a personal loan, and a loan matching platform like Lendela to manage these huge expenses.

The Triple Threat: Wedding, home & renovation

For many young couples in Singapore, a wedding is the first big-ticket item on the list, followed closely by a new home, embarking on the rite of passage of home renovation, and finally settling into a mortgage. While these milestones are cause for celebration, they are also some of the costliest milestones in our lives, and can place significant strain on a couple's finances.

Wedding: A traditional Singaporean wedding can cost as much as $80,000, including banquet costs, attire, and photography.

Home purchase: A three-room BTO flat starts at about $250,000 and as we’ve all come to learn, can go well over a million dollars these days. According to the June 2024 BTO exercise, four-room flats in non-mature estates ranged from $219,000 to $285,000 after grants, while a three-bedder executive condo in Yishun will set you back about $1.3 million.

Mortgage: For a four-room BTO flat priced around $400,000 after grants, assuming an HDB loan of $300,000 with an interest rate of 2.6% per annum and a loan tenure of 25 years, monthly mortgage payments would be in the range of $1,300 to $1,400. The same executive condo at $1.3 million with a 25% down payment and a 3.75% bank loan interest rate will mean a mortgage of about $5,000.

Renovation: Home renovations can average anywhere between $34,000 for three-room flats to $70,000 for five-room flats, with people often spending more than that.

Strategies to stay on top

Prioritise & budget

The key to balancing these expenses is prioritising what's most important. Is the wedding where you want to spend more, or is your renovation a bigger priority? Once you've made that decision, developing a comprehensive budget that covers all foreseeable costs would be a rational next step. While it may seem simplistic, a well thought out budget will help you allocate funds accordingly and avoid overextending yourself, and is something many couples fail to do.

Timing is everything

One way to manage the financial pressure is by spacing out these major expenses when possible. For example, if you can delay your home renovation for a year or two after the wedding, you’ll have more time to grow your savings. While not something most people think of doing, it can be a strategic financial move that helps you get back on your feet a lot quicker after a dream wedding.

Mitigate long-term impact

As mentioned before, while it's tempting to focus on the excitement of the moment, it's essential to take a step back and consider the long-term financial impact of these major milestones. Upfront costs are just the tip of the iceberg — they’ll affect your cash flow for years through mortgage payments, loan interest, maintenance, and depreciation.

While your mortgage may seem affordable today, it’s a decades-long commitment, so accounting for what happens if interest rates rise or your income unexpectedly dips is one way to mitigate negative long-term impact.

Furthermore, ensure that you are not stretching your budget so thin that you're unable to handle unforeseen expenses, emergencies, or save to start a family or retire.

Navigating each milestone

Wedding wisdom: Saving without the sacrifice

A wedding is one of the most memorable moments in life, but it’s also one of the priciest. In Singapore, wedding banquets often start from about $30,000 and can climb past $80,000 depending on the venue, number of guests, and whether it’s a weekday or weekend event. Add in photography, your attires, and miscellaneous expenses, and costs will easily climb higher.

Weekday banquets: While it’s tempting to splurge on your dream wedding, there are smart ways to save without sacrificing key elements of the experience. For example, opting for a weekday banquet can save thousands of dollars, especially for big weddings, since you can expect to save up to a few hundred dollars on each table.

Intimate weddings: Alternatively, consider hosting a smaller, more intimate wedding to keep your guest list manageable. Don’t be afraid to negotiate with vendors, either — many wedding photographers or florists are open to customising packages based on your budget.

A wedding loan: Finally and seldom discussed — the idea of a personal loan to help with wedding expenses is a popular option among Singaporean couples.

If you’ve decided to take out a loan, instead of applying across multiple banks and risking multiple credit checks, using a loan matching platform like Lendela allows you to unlock multiple personalised offers from banks and trusted providers with just one online application, protecting your credit score and allowing you to focus on planning your big day knowing you have the most competitive financing options at your fingertips.

Mastering the mortgage: Making an informed decision

Apart from the costs already shared above, a mortgage also comes with a decades-long commitment, so it’s crucial to make an informed decision from the outset.

Understanding different mortgage types can save you a significant amount of money in the long run.

For instance, if interest rates have been fluctuating over recent years, a fixed-rate mortgage would offer stability in repayments, while a floating-rate mortgage could save you money in the short term if interest rates drop, but might become much more expensive if rates rise due to changing economic conditions around the world.

Renovation realities: Balancing desires with your budget

You’ve finally received the keys to your new flat — now comes the fun part: renovations. Depending on your design choices, costs can quickly snowball when adding in kitchen overhauls, new flooring, or extensive carpentry.

To avoid overspending, it’s important to balance your immediate desires with the realities of your budget (discussed above).

Start with a renovation plan that prioritises mutual needs, moving down to nice-to-haves. This ensures your budget is focused on agreed essentials, reducing any regret further down the road.

Avoid choosing the cheapest materials as they often lead to higher costs for repairs and replacements. Opt for durable yet affordable options, and save non-essential aesthetics like decor and loose fixtures for when finances allow.

If your renovation requirements exceed your savings, taking out a personal loan is a common option for many Singaporeans.

Avoiding common pitfalls

The high-interest debt trap

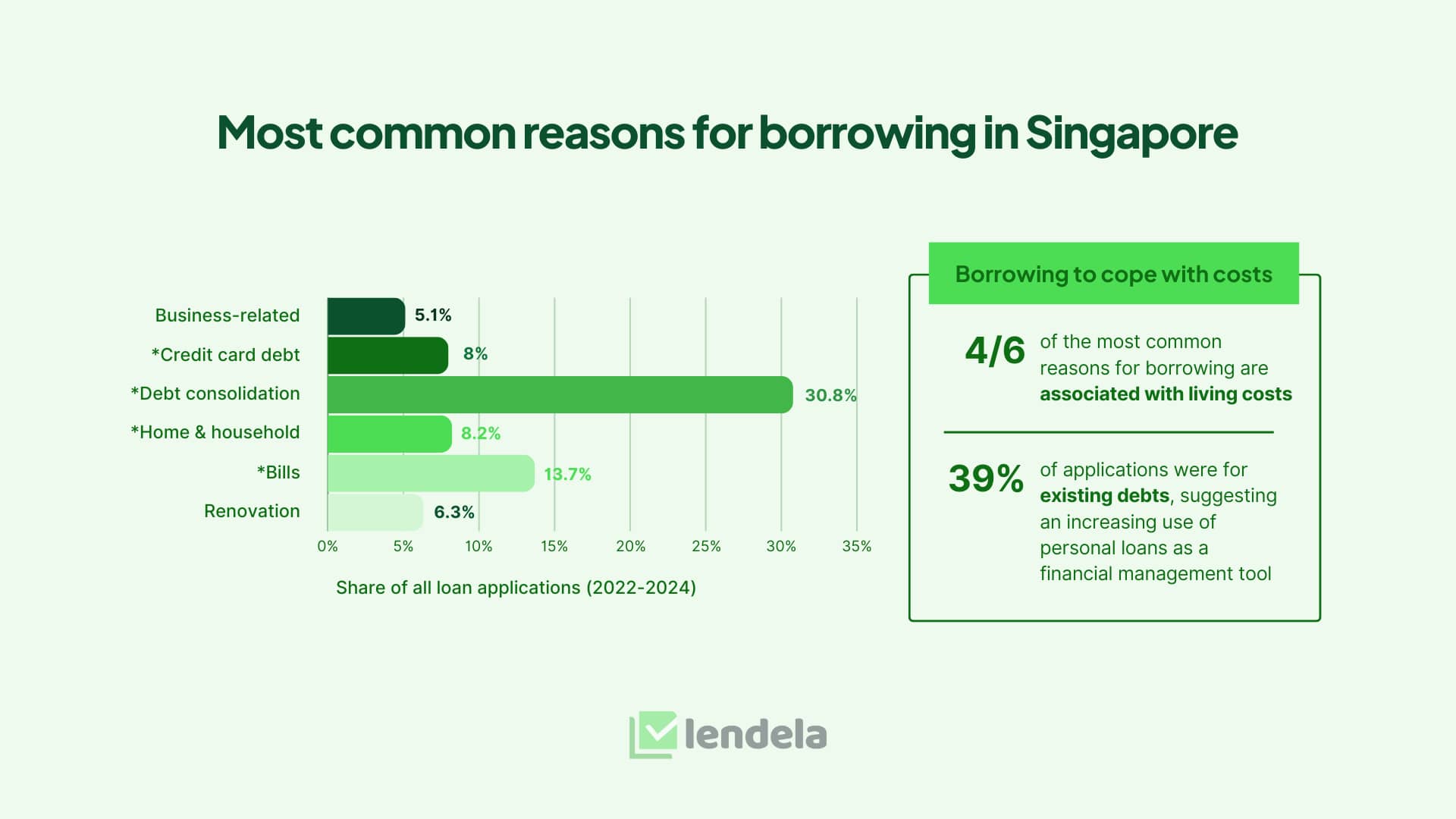

According to Lendela’s August report, Coping in the costliest city in the world, renovations and home-related expenses were two of the six most common reasons for borrowing between 2022 and 2024.

Source: Lendela media report - Coping in the costliest city in the world

Source: Lendela media report - Coping in the costliest city in the world

This is crucial for young couples to note — while credit cards are often the default option for many Singaporeans, they’re not the only way to handle large costs.

Couples should consider how rolling interest on high-cost credit could affect their finances, especially if circumstances force smaller payments later.

A low-interest personal loan with suitable terms could be a better option, saving thousands over time.

Using a loan matching platform to find affordable loans that fit your financial plan can help avoid high-interest credit. Lendela’s data shows 8% of nearly 200,000 loan applications between 2022 and 2024 were for credit card debt, highlighting the need for better credit management as average credit card interest in Singapore is around 28% annually.

Hidden costs

Weddings, home renovations, property purchases, and mortgages often come with hidden costs that can catch couples off guard.

For weddings, these can include anything from service charges and corkage fees to dry cleaning, rush fees, and miscellaneous decor.

"Home renovations often come with hidden fees, like plumbing or structural issues, and incorrect measurements can add costs from returns or replacements.

Choosing the right renovation loan is crucial due to their size and interest, but we often don’t know all our options, making it hard to choose the best one for our credit profile.

Applying to multiple banks can hurt your credit score, so using Lendela’s loan matching service, which provides personalised offers from various lenders with one application, helps you access and choose from options without the hassle.

For homes and mortgages, don’t forget about legal fees, stamp duties, and valuation costs, which will add at least a five-figure sum to your total cost.

Failing to plan ahead

One of the most common financial pitfalls for couples is failing to plan for the future. Weddings, homes, and renovations may feel like all-consuming priorities, but they are just the beginning of your financial journey.

If you don’t take the time to think beyond these milestones, you may find yourself financially stretched when other life goals start creeping in.

In Singapore, where the cost of living is among the highest in the world, the need for forward planning is even more pressing. Without a clear, long-term strategy, couples may find themselves struggling to balance immediate needs with aspirations.

Transparent communication: The key to unlocking happy milestones

The foundation of financial stability in a relationship is, as they always say, transparent communication. Couples should discuss their financial priorities regularly, set realistic expectations, and check in with each other on their financial progress.

By having open conversations about money and adjusting your plans as needed, coupled with some careful planning and the right financial tools, you can ensure that financial stress doesn’t overshadow the joy of life’s biggest milestones.