The Lendela Lowdown

Quick financial support: Personal loans are known for their quick approval and disbursement process relative to typical secured loans (renovation and car loans for example), making them very useful in times of emergency.

Creditworthiness is critical in crises: Unlike most types of loans, personal loans are unsecured so you don't need collateral like a property or car to get one. However, we also explain below why this means that your credit score becomes critical if you are to leverage personal loans in urgent crises.

Always find personalised loan offers: While it can be hard to remember during a personal crisis, it is incredibly important to ensure the loan you get can be managed comfortably over its tenure, in order not to end up in an unsustainable debt cycle. Below, we explain how loan matching platforms like Lendela match borrowers with personalised loan options in minutes after understanding their circumstances.

Emergencies can strike at any time and in any form. From an abrupt retrenchment to a road accident, we are generally pretty vulnerable to these things, and we all probably know at least one person in our lives who landed in a tight spot because of an emergency.

And yet, the data from recent years points to a problem not many are talking about — OCBC’s 2021 Financial Wellness study found that about half of surveyed Singaporeans do not have an adequate emergency fund (at least six months worth of one’s salary). Another 2023 survey found that two in three working Singaporeans don’t have six months worth of cash savings to tide them over if they lose their job, while 18% only have enough savings to last a month.

As most emergencies involve a financial element, we thought it’d be a good time to talk about an unexpected lifeline that we have seen help Singaporeans in emergencies — the personal loan. Here, we break down exactly why personal loans can be useful in times of crisis and how one might go about applying for the right one when push comes to shove.

Common types of emergencies in Singapore

Medical

Health emergencies can happen at any time and not just to yourself but also your family. These can result in unexpected medical bills, surgery costs, or long-term treatment expenses. In 2024, the average bill size for public hospitals was found to start from about $1,000 and go up to $7,800, with surgical procedures going as high as $10,500. The average bill size for private hospitals starts from $3,900 and can go as high as $25,000.

Especially with public healthcare costs reportedly rising 4.5% annually and private healthcare costs growing at 9% between 2007 and 2017, we expect medical emergencies to remain one of the most common reasons Singaporeans borrow for, and personal loans have become popular for this very reason due to their versatility, speed of approval, and the options available.

Home repairs

When your home faces sudden damage, such as a burst pipe or a leaking ceiling, immediate repairs are essential to prevent further damage. Personal loans are commonly used by homeowners in Singapore for urgent home repairs, potentially saving the integrity of their homes or preventing the spread of damages.

Car repairs

Driving is one of the most expensive expenses in the country, and for good reason. Drivers know that when their car breaks down unexpectedly, it’s not uncommon to discover at the workshop that a seemingly minor issue costs thousands, if not tens of thousands of dollars. In these situations, instead of emptying one’s savings account or dipping into investments, many Singaporeans have turned to personal loans to cover urgent repair costs and ancillary expenses resulting from the loss of a vehicle.

Debt consolidation

Credit Counselling Singapore (CCS) recently reported a 7% increase in borrowers seeking help between November 2023 and April 2024, while consumer debt has also been observed to be rising, especially among younger adults. According to CCS, Singaporeans tend to accumulate debt over time due to the practice of rolling over balances and incurring high interest rates (up to 27.9%). In 2023, the average debt size for borrowers seeking CCS's assistance was about $95,409, with a median debt size of $51,609.

In the case of someone drowning in multiple high-interest debts, a personal loan can also be used for debt consolidation. It allows you to pay off your existing debts with a single loan, thus consolidating your debts into a single monthly loan repayment, often at a lower interest rate. We discuss this in detail below.

Loss of income

The loss of employment or a significant income interruption can be financially devastating to households. Personal loans can provide temporary financial relief to cover essential living expenses until a family member of yours finds new employment or your household resolves the loss of income.

How personal loans became an emergency lifeline for Singaporeans

Quick access to funds

The nature of emergencies means that we are often forced to seek financing urgently. While personal loans may not be the only option out there, it’s often one of the quickest ways to get extra funds — for instance, after matching with your personalised loan offers on Lendela, it can take as little as 20 minutes to see the funds in your bank account.

Importantly, while quick access to funds can be a lifeline, it’s crucial to have a good view of all the loan options available to you before making a decision on a loan, as this often results in thousands saved in interest.

Unfortunately, in times of crisis, this is often the last thing Singaporeans think about. This is one of the best arguments for loan matching solutions like Lendela, because the platform matches you with personalised, pre-approved offers from over 50 banks and providers in just minutes. This means that instead of searching for loan options aimlessly from one bank to the other, applying for multiple loans to find your lowest rate, loan matching brings you your best rates automatically.

In times of vulnerability, this solution becomes the real lifeline.

No collateral required

Personal loans offer the flexibility that typical secured loans don’t. Unlike housing or car loans, personal loans can be used for a variety of needs. This could mean covering medical expenses, fixing an urgent structural issue at home, or simply keeping up with daily expenses during a rough patch. The freedom to use the money where it’s needed most can make things a lot simpler in complex situations where circumstances may change at any time.

Lower interest rates than credit cards or lines of credit

It might be tempting to use a credit card or line of credit to cover large emergency expenses, but the high interest rates often snowball quickly. Credit card interest rates in Singapore can go as high as 27.9% per annum, as we found out above.

In contrast, personal loans typically offer much lower interest rates, sometimes under 3%, making them a significantly more cost-effective solution for large unexpected expenses — we’re talking as much as tens of thousands in savings on interest over the lifespan of a loan. And while time is of the essence during an emergency, as we explained above, loan matching can lay out all your best personalised loan options in front of you in a matter of minutes, saving you both time and money in crucial moments.

Consolidating high-interest debts

If you’re drowning in multiple high-interest debts, a personal loan can help you consolidate them into a single, lower-interest loan. This not only simplifies your finances massively but also reduces the total amount of interest you pay at the end of it all, sometimes by thousands of dollars.

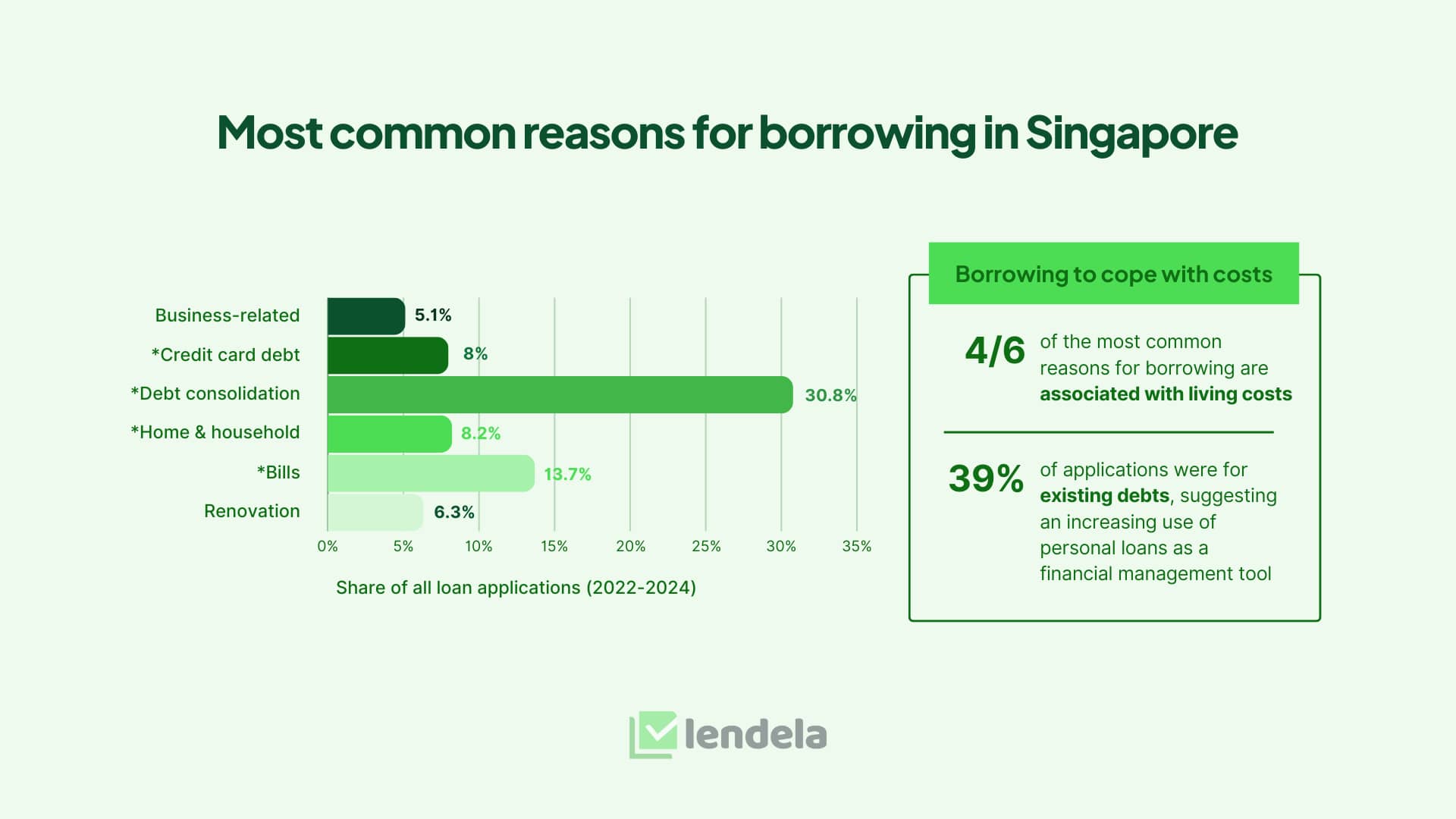

In fact, debt consolidation is a strategic personal finance tool that most borrowers in Singapore leverage — according to data from Lendela’s August 2024 report, Coping in the costliest city in the world, almost a third of borrowers who use our platform have used it to consolidate their debts, allowing them to keep their credit manageable during tough times.

Source: Lendela media report - Coping in the costliest city in the world

Source: Lendela media report - Coping in the costliest city in the world

Keeping it together in emergencies

Intuitively, we all rush to take action during emergencies. In a time of crisis where the lack of a financial buffer disrupts your daily life and causes panic, the stress that comes with it increases the likelihood of impulsive spending, inconsistent saving, and other bad financial habits, clouding your ability to make good long-term financial decisions.

In such times, keeping it together and calming your mind is often the first step to take, and a personal loan can potentially be a cost-effective and time-saving way to alleviate most of this stress by helping you maintain your lifestyle, cover essential expenses like rent, utilities, and groceries, and providing you the peace of mind to focus on resolving the crisis at hand.