One way to meet the big-ticket expenses in life is to save up for those purchases. But what if you have an unexpected expense to take care of? Or, what if you do not want to dip into your savings for making a premium purchase or taking your dream vacation? Well, in that case, borrowing money is a great way to meet major expenses without breaking into your investments.

And when it comes to borrowing money that can be used for various flexible purposes, there are two main alternatives available to you – credit cards and personal loans. Both these forms of credit are extremely popular among the general population.

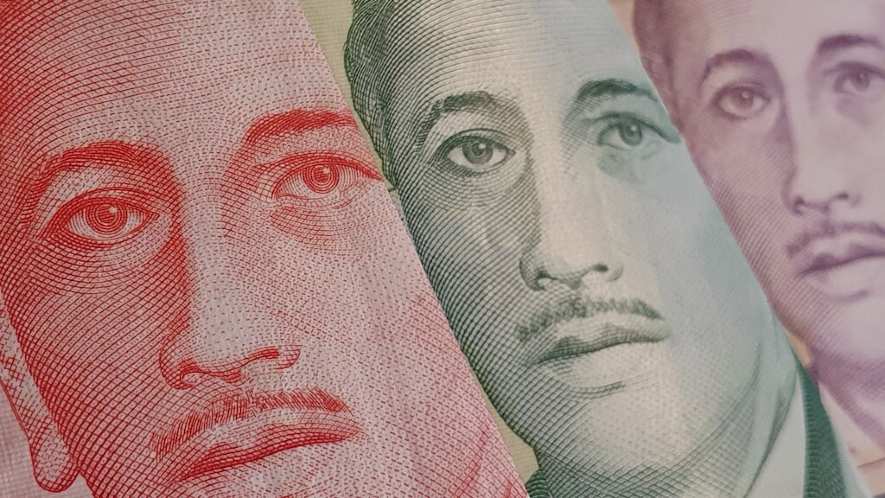

In fact, nearly every other person you meet or know probably has a credit card or two in their wallet. Data shows that around 73% of Singaporeans own at least one credit card. And over half of the people – 56% to be precise – own more than one credit card.

Statistics also show that personal loans are highly popular in Singapore. According to a recent survey, around 32% of respondents admitted to availing a personal loan over the course of the previous year. Now, with both credit cards and personal loans being highly preferred, which form of credit should you choose?

Comparing the pros and cons of each alternative can help resolve the credit card vs. personal loan dilemma faster. So, let’s take a look at the two sides of the coin for credit cards and personal loans.

The pros and cons of credit cards

Credit cards have many upsides to offer. Here is a preview:

Easy access to credit

Accessing credit with credit cards is extremely easy. With an active card, all you need to do is swipe the product to instantly pay for purchases using credit. And if you don’t own a card yet, it is a simple process to apply for one. In many cases, applying for credit cards can be done online, in a matter of a few minutes.

Enjoy offers and deals

Many credit card companies offer introductory offers that you can take advantage of. You can also benefit from a number of other incentives and offers like cash back deals, reward points, and discounts on purchases made using the credit facility. When used prudently, these rewards can even reduce your overall outlays.

Zero interest period

Credit cards have a zero interest period, during which no interest charges are levied on the outstanding credit you owe. If you consistently manage to repay your dues within this grace period, you can enjoy the benefit of short-term credit without paying additional charges as interest.

If you are planning to choose credit cards, you should also be aware of the limitations they come with, such as:

The trap of the minimum due amount, which can mislead customers into thinking they can spend a lot more, since they assume their bill is low

The problem of hidden charges, which could rack up the overall expense total

Extremely high rate of interest, which can lead you to fall into a debt trap surprisingly quickly

The pros and cons of personal loans

Like credit cards, personal loans also offer many advantages to borrowers. Let us take a look at some of their main upsides:

Lower rate of interest

In the credit card vs. personal loan debate, personal loans come with a lower rate of interest, thereby reducing the overall costs in the long run. With a good credit profile, you may even get to enjoy lower rates of interests, so you can reduce the cost of debt and redirect those resources to your savings or investments.

Predetermined repayment schedule

The repayment schedule for personal loans is determined beforehand. Based on the fixed rate of interest you are charged, you will need to pay the same amount each month, for a predetermined tenure. So, you can plan your finances accordingly, well in advance. This certainty is lacking in the credit card system, where the amount you repay depends on the amount you spend.

Flexible repayment parameters

With personal loans, you can choose from a flexible repayment tenure ranging from a few months to a few years, depending on the lender you select. This inevitably gives you control over the amount of EMIs (equated monthly instalments) you repay over the course of the loan’s tenure. You can also choose the amount you will borrow, thereby making it easier to remain within your budget.

Personal loans also come with a few limitations, like:

Prepayment charges (with certain lenders)

A cap on the maximum amount you can borrow

Possibility of a scam offer if you don’t borrow from a legitimate lender

The takeaway: How do you choose between the two

So, credit card vs. personal loans – who wins the face-off? Well, that ultimately depends on your individual requirements. Credit cards could be suitable for smaller purchases that you intend to pay off quickly.

Personal loans, on the other hand, are better for larger spends that may take longer to pay off. If that is what you are looking for, you can use Lendela to choose from a number of legitimate lenders who offer personal loans at attractive rates of interest in Singapore. Lendela will help you compare the various offers available, so that you can identify the one that is best for you. Simply apply here to receive multiple personalised loan offers from a variety of banks and financial institutions, for free.